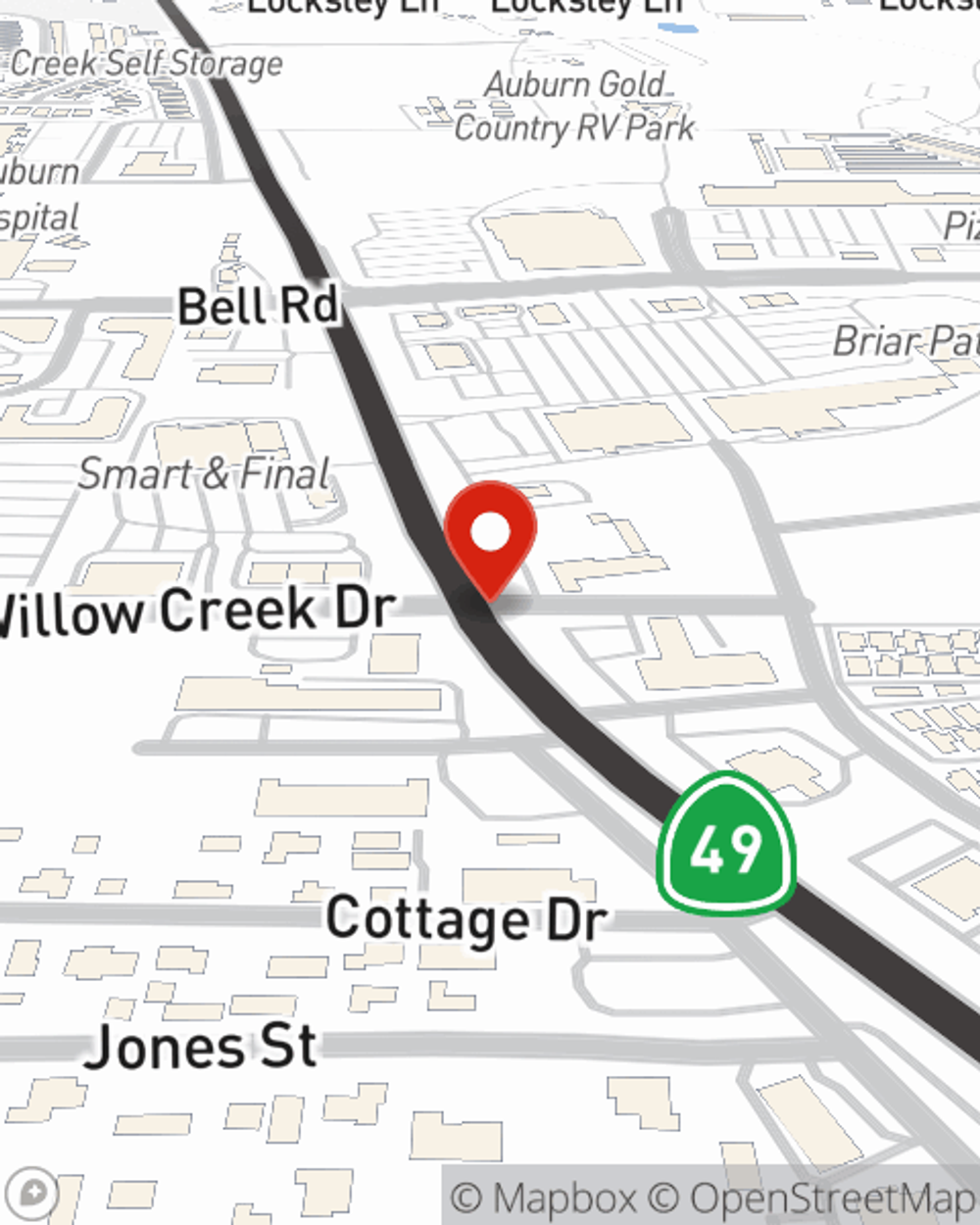

Auto Insurance in and around Auburn

The first choice in car insurance for the Auburn area.

Put it into drive, wisely

Would you like to create a personalized auto quote?

Be Ready For The Unexpected

You've got the vehicle. Now it's time to change lanes and choose the right protection.

The first choice in car insurance for the Auburn area.

Put it into drive, wisely

Great Coverage For A Variety Of Vehicles

With John Aitken's assistance, you'll get flexible coverage for your vehicles, from pickup trucks to SUVs. And Agent John Aitken can share more information about State Farm's savings options—such as our Safe Driver Program and Drive Safe & Save™—and a wide range of policy inclusions—such as Emergency Roadside Service (ERS) coverage and car rental insurance.

You don't have to ride solo when you have insurance from State Farm. Call or email John Aitken's office today for more information on the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call John at (530) 885-5104 or visit our FAQ page.

Simple Insights®

Quick steps to take if your gas pedal sticks

Quick steps to take if your gas pedal sticks

If your gas pedal sticks, do you know what to do? State Farm offers helpful tips on what to do, and on preventative technology such as Smart Throttle.

How to sell a motorcycle

How to sell a motorcycle

Whether you're selling a motorcycle now or perhaps you're just thinking about it, here are some tips that can help when you're ready to sell your motorcycle.

John Aitken

State Farm® Insurance AgentSimple Insights®

Quick steps to take if your gas pedal sticks

Quick steps to take if your gas pedal sticks

If your gas pedal sticks, do you know what to do? State Farm offers helpful tips on what to do, and on preventative technology such as Smart Throttle.

How to sell a motorcycle

How to sell a motorcycle

Whether you're selling a motorcycle now or perhaps you're just thinking about it, here are some tips that can help when you're ready to sell your motorcycle.